The gross receipts tax in the City of Las Cruces is currently 8.0625%, one of the highest amongst New Mexico’s most populous cities. This summer, the city passed a resolution that will put the question to voters on whether that tax is raised.

This November, Las Cruces residents will have the option to raise the city’s GRT by .325%, or about 30 cents for every hundred dollars spent. Advocates for the tax say that the money could be used for quality-of-life improvements, including improving the city’s parks and public safety resources. But those against argue that the city should use other avenues to find the money for improvements – without adding more tax burden for residents.

Deputy Director of Economic Development for the City of Las Cruces Chris Faivre said that if the increase is passed, then it would mean approximately $11 million for the city, which he said would be set aside from the general fund.

“The city is looking to use these funds to set up a capital improvement fund that will be specific for public safety, street improvements, and potentially some indoor recreational facilities,” Faivre said. “If this measure passes, the intent is that they will set up a fund where these monies come in every year, and they’re set aside specifically for projects council votes on. So, the plan would be after it passes, it will go into effect in July of 2025.”

If voters pass the increase, then Las Cruces residents will be paying the highest gross receipts tax among the top five most populous municipalities in the state, although Faivre said that this is only part of the story.

“It’s not an apples-to-apples comparison to say that just because the GRT in one city is lower, then those citizens are paying less money than Las Cruces is, there’s many other taxes that sort of need to be factored into that calculation. So yes, it will be a little bit higher, but also, relatively speaking, our property taxes are a lot lower here than in a lot of other communities in New Mexico,” Faivre said. “The reality is the more projects that we have up and running and have funding, the more likelihood is that we can get money from the state.”

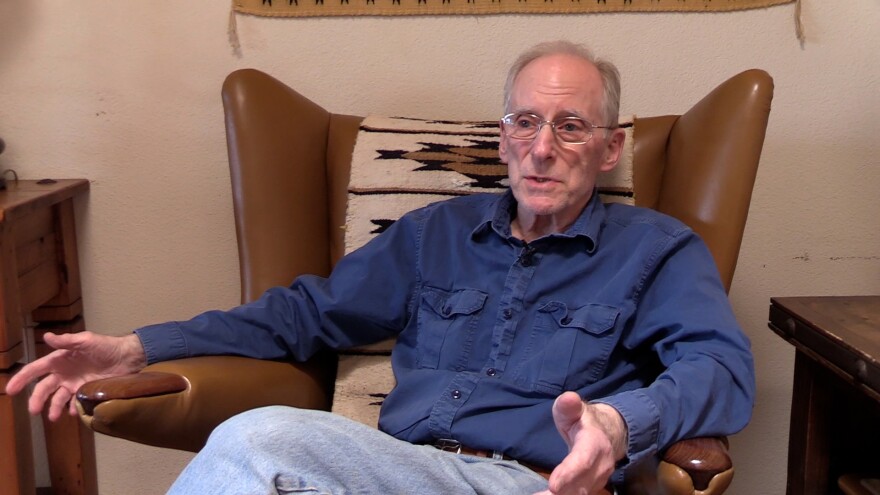

But not all residents are sold on the idea of increasing the GRT. Michael L. Hays is a retired Las Cruces resident and blogger, and said the city should be focusing on fiscal responsibility, rather than seeking a higher GRT rate.

“I’m not quite sure what it’s buying if it went through. I’ve heard that they’re going to have it to set aside and make up their mind after they’ve got the money. That’s a strange ask,” he said. “My thinking is that the city has got enough money in its budget to finance these things without asking more money if they were more efficient in using the money they already collect.”

Hays pointed to a number of LCPD lawsuits, as well as his own settlement against the city tied to violations of the state’s Inspections of Public Records Act, as an example of fiscal irresponsibility from city leadership.

“I think that if a city were run on good government principles and respect for the taxpayer dollars, I would expect that the city would come forward with an actual plan of why we need additional funds, and they would specify what those projects are,” he said. “I think that the citizens need to know what the money is going to be spent on, not give the city a blank check and then say go to the mall and treat yourself.”

The Mayor of Las Cruces, Eric Enriquez, is a vocal supporter of the increase, and said that if Las Cruces wants to see improvements, then the city needs more money to work with.

“I truly do understand that taxes are a burden. I understand that taxes are viewed negatively. I know that government [is viewed] in the same way. But I ask the community to put faith and trust in us that we’re going in the right direction so that our community can thrive, and that burden turns into a blessing,” Enriquez said. “We all have to sacrifice a little bit for the betterment of our community, because we don’t just want to be known as Las Cruces, the second largest city in New Mexico. We want to be known as Las Cruces, the best city in New Mexico.”

Mayor Eric Enriquez said it would be a permanent tax hike with no sunset period, and said that if the ballot measure doesn’t pass, then the council won’t raise the tax via ordinance, even though they technically have the power to do so.

“There’s a .25% increase that mayor and council have the authority to initiate without a voter turnout. We’ve elected not to do that so we can take it to the voters and go for the .325% increase and not mess or deal with the .25 and let the voters decide,” Enriquez said. “What I would hope is that we would have [the tax] long term, that it would stay because of the growth that we’re experiencing. It will be permanent.”

As the general election approaches, Las Cruces voters face a choice of raising their own taxes for additional funding for the city, or indicate that the city should find a different path for funding sources.

New Mexico’s early voting window is open now through November 2, with expanded early voting locations opening on October 19. Residents of the state who have yet to register can still do so in person to vote all the way up through election day on Tuesday, November 5.

Do you have questions about this year’s upcoming election? If so, visit the KRWG News Election Center! Here, you can find essential voting information, candidate interviews, and give your thoughts on issues most important to your community as it relates to the general election. Our goal is to amplify your voice and answer any questions you might have when it comes to voting and holding our public officials accountable.